All Categories

Featured

Table of Contents

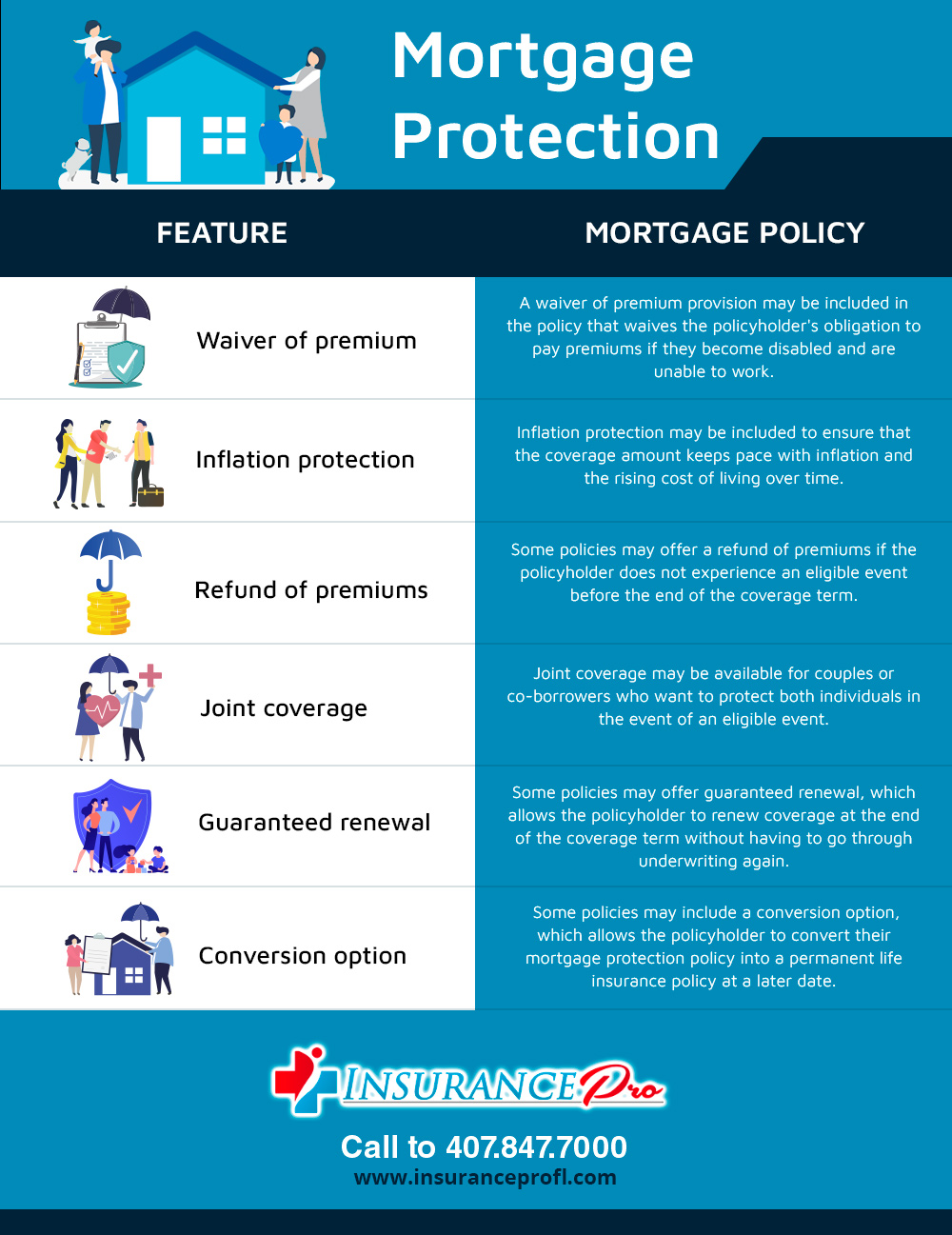

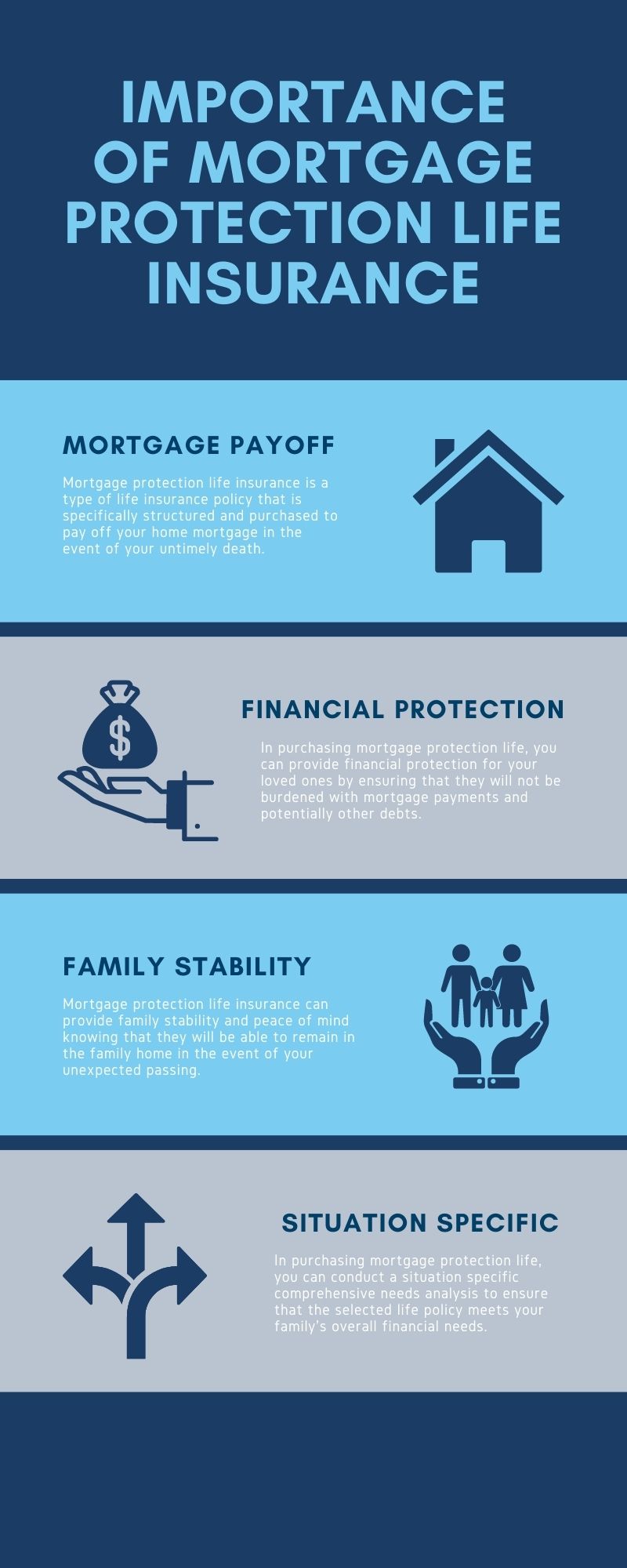

Home mortgage life insurance policy offers near-universal protection with very little underwriting. There is commonly no medical checkup or blood sample required and can be a beneficial insurance coverage plan option for any type of home owner with serious pre-existing medical problems which, would prevent them from getting traditional life insurance policy. Various other benefits consist of: With a home loan life insurance coverage plan in position, beneficiaries will not have to stress or question what might take place to the family members home.

With the mortgage repaid, the family will always have a location to live, offered they can afford the building tax obligations and insurance coverage annually. mortgage insurance job loss protection.

There are a few various kinds of mortgage defense insurance policy, these consist of:: as you pay more off your mortgage, the quantity that the policy covers lowers according to the superior balance of your home loan. It is one of the most common and the most inexpensive form of home mortgage protection - mortgage redundancy protection insurance.: the quantity insured and the costs you pay stays level

This will repay the home mortgage and any type of continuing to be balance will go to your estate.: if you desire to, you can include serious illness cover to your home mortgage protection policy. This indicates your home loan will certainly be removed not just if you die, however also if you are identified with a severe health problem that is covered by your policy.

Mortgage Insurance Providers Usa

In addition, if there is an equilibrium continuing to be after the home mortgage is removed, this will certainly go to your estate. If you alter your home mortgage, there are a number of points to consider, relying on whether you are covering up or extending your home mortgage, changing, or paying the mortgage off early. If you are covering up your home loan, you require to make certain that your plan fulfills the brand-new value of your mortgage.

Compare the prices and benefits of both options (insurance that pays off your home). It might be less costly to keep your initial home mortgage defense plan and after that buy a 2nd policy for the top-up quantity. Whether you are topping up your home loan or expanding the term and require to get a brand-new plan, you might find that your costs is more than the last time you got cover

Mortgage Insurance Is It Worth It

When changing your mortgage, you can designate your home loan security to the new lender. The premium and degree of cover will certainly coincide as before if the quantity you obtain, and the regard to your home loan does not change. If you have a plan via your lending institution's group system, your lending institution will terminate the policy when you change your mortgage.

In California, home loan security insurance policy covers the entire impressive balance of your financing. The death benefit is a quantity equivalent to the equilibrium of your home loan at the time of your passing away.

Payment Protection Insurance Next Directory

It's necessary to comprehend that the survivor benefit is offered straight to your financial institution, not your enjoyed ones. This guarantees that the continuing to be financial debt is paid in full and that your liked ones are spared the economic stress. Home mortgage defense insurance coverage can likewise provide short-term protection if you end up being impaired for an extended period (usually 6 months to a year).

There are several advantages to obtaining a mortgage defense insurance policy in The golden state. A few of the top advantages consist of: Guaranteed authorization: Even if you remain in poor health or operate in a hazardous profession, there is guaranteed approval with no medical tests or laboratory tests. The exact same isn't true permanently insurance coverage.

Impairment protection: As stated above, some MPI policies make a few home loan payments if you end up being impaired and can not bring in the very same revenue you were accustomed to. It is essential to note that MPI, PMI, and MIP are all different kinds of insurance policy. Home loan protection insurance (MPI) is made to pay off a mortgage in instance of your death.

Buy Mortgage Protection Leads

You can even use online in minutes and have your plan in location within the very same day. For more details concerning getting MPI coverage for your home car loan, get in touch with Pronto Insurance policy today! Our educated agents are here to respond to any type of questions you may have and give additional help.

It is suggested to compare quotes from various insurers to locate the very best price and coverage for your requirements. MPI supplies a number of advantages, such as satisfaction and streamlined certification procedures. It has some limitations. The death benefit is directly paid to the lending institution, which restricts adaptability. In addition, the benefit amount lowers in time, and MPI can be more pricey than standard term life insurance policy plans.

Mortgage Protection Agency

Go into standard info about on your own and your mortgage, and we'll compare rates from various insurance companies. We'll additionally reveal you just how much insurance coverage you need to secure your mortgage.

The primary advantage below is clarity and self-confidence in your decision, recognizing you have a plan that fits your needs. Once you authorize the plan, we'll manage all the documentation and configuration, guaranteeing a smooth application process. The positive outcome is the comfort that comes with recognizing your household is secured and your home is protected, regardless of what occurs.

Expert Recommendations: Support from experienced specialists in insurance policy and annuities. Hassle-Free Setup: We deal with all the paperwork and application. Economical Solutions: Discovering the finest insurance coverage at the most affordable feasible cost.: MPI specifically covers your home loan, supplying an added layer of protection.: We function to discover one of the most affordable services tailored to your spending plan.

They can give info on the coverage and advantages that you have. Generally, a healthy individual can anticipate to pay around $50 to $100 monthly for mortgage life insurance policy. It's recommended to get a personalized mortgage life insurance quote to obtain an accurate price quote based on private situations.

Latest Posts

Funeral Cover With No Waiting Period

Funeral Policy Cover

The Best Final Expense Company