All Categories

Featured

Table of Contents

They commonly provide a quantity of insurance coverage for a lot less than permanent kinds of life insurance policy. Like any type of policy, term life insurance coverage has benefits and drawbacks depending upon what will function best for you. The benefits of term life consist of affordability and the ability to personalize your term size and insurance coverage amount based on your needs.

Depending on the type of plan, term life can supply fixed costs for the entire term or life insurance coverage on degree terms. The fatality benefits can be fixed.

Premium Joint Term Life Insurance

You need to consult your tax obligation consultants for your certain accurate situation. Fees show plans in the Preferred And also Price Class concerns by American General 5 Stars My agent was really knowledgeable and practical in the procedure. No pressure to buy and the procedure was fast. July 13, 2023 5 Stars I was pleased that all my requirements were satisfied without delay and properly by all the representatives I talked to.

All paperwork was electronically completed with access to downloading for individual data maintenance. June 19, 2023 The endorsements/testimonials provided should not be interpreted as a recommendation to purchase, or an indication of the worth of any services or product. The endorsements are actual Corebridge Direct clients who are not affiliated with Corebridge Direct and were not provided payment.

2 Cost of insurance policy rates are figured out making use of approaches that differ by firm. It's vital to look at all variables when examining the overall competition of rates and the worth of life insurance coverage.

Renowned Voluntary Term Life Insurance

Like a lot of team insurance policy plans, insurance policy plans used by MetLife include certain exclusions, exceptions, waiting periods, decreases, restrictions and terms for maintaining them in pressure (decreasing term life insurance). Please contact your advantages administrator or MetLife for costs and complete information.

Generally, there are two kinds of life insurance intends - either term or irreversible plans or some combination of the 2. Life insurance providers use various kinds of term strategies and traditional life policies in addition to "interest sensitive" items which have come to be extra widespread since the 1980's.

Term insurance policy gives protection for a specified duration of time. This period can be as brief as one year or offer protection for a certain number of years such as 5, 10, two decades or to a defined age such as 80 or in many cases as much as the oldest age in the life insurance policy death tables.

Does Term Life Insurance Cover Accidental Death

Presently term insurance coverage rates are very competitive and amongst the least expensive historically knowledgeable. It needs to be noted that it is a commonly held idea that term insurance is the least costly pure life insurance policy coverage offered. One requires to examine the plan terms very carefully to determine which term life options are ideal to satisfy your specific scenarios.

With each brand-new term the premium is raised. The right to restore the plan without proof of insurability is an important advantage to you. Otherwise, the threat you take is that your health and wellness might weaken and you may be unable to acquire a policy at the very same prices and even at all, leaving you and your beneficiaries without coverage.

The length of the conversion duration will certainly vary depending on the kind of term plan purchased. The costs rate you pay on conversion is normally based on your "present achieved age", which is your age on the conversion date.

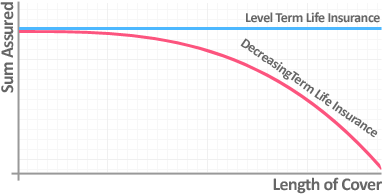

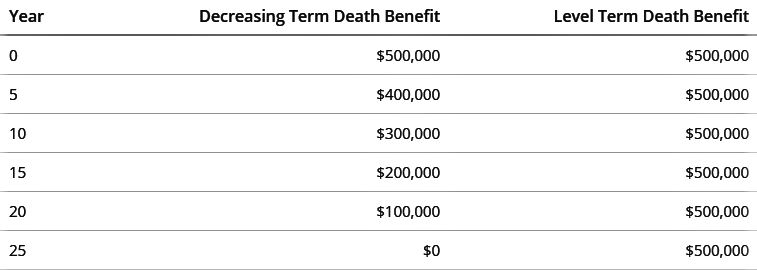

Under a degree term plan the face quantity of the policy continues to be the very same for the whole period. With reducing term the face quantity minimizes over the period. The costs remains the same annually. Typically such policies are marketed as mortgage security with the quantity of insurance coverage lowering as the balance of the mortgage reduces.

Traditionally, insurance companies have not can alter costs after the policy is marketed (a term life insurance policy matures). Given that such plans may continue for years, insurance firms need to utilize conventional death, rate of interest and cost rate price quotes in the costs estimation. Adjustable costs insurance policy, however, enables insurance companies to provide insurance policy at reduced "present" premiums based upon less conservative assumptions with the right to alter these premiums in the future

Budget-Friendly Term Life Insurance With Accelerated Death Benefit

While term insurance is created to give security for a specified time duration, permanent insurance is developed to give protection for your whole lifetime. To keep the costs rate degree, the costs at the younger ages goes beyond the real price of security. This extra premium constructs a book (cash money worth) which aids pay for the plan in later years as the expense of security surges over the premium.

The insurance business spends the excess costs bucks This type of plan, which is occasionally called cash worth life insurance, generates a savings element. Cash worths are crucial to an irreversible life insurance plan.

Flexible Decreasing Term Life Insurance Is Often Used To

Occasionally, there is no relationship in between the dimension of the money value and the premiums paid. It is the cash worth of the plan that can be accessed while the policyholder lives. The Commissioners 1980 Criterion Ordinary Mortality Table (CSO) is the current table used in computing minimum nonforfeiture values and plan books for average life insurance coverage plans.

Several permanent policies will certainly contain provisions, which specify these tax obligation demands. There are 2 fundamental categories of long-term insurance, standard and interest-sensitive, each with a variety of variations. Additionally, each classification is usually readily available in either fixed-dollar or variable type. Conventional entire life plans are based upon long-lasting price quotes of expense, interest and mortality.

If these estimates transform in later years, the firm will readjust the costs accordingly however never over the optimum ensured costs mentioned in the plan. An economatic entire life policy attends to a basic quantity of participating entire life insurance policy with an added supplementary protection given through using returns.

Due to the fact that the costs are paid over a much shorter period of time, the premium payments will certainly be more than under the whole life strategy. Single costs entire life is limited payment life where one large exceptional repayment is made. The plan is completely compensated and no further costs are needed.

Latest Posts

Funeral Cover With No Waiting Period

Funeral Policy Cover

The Best Final Expense Company